This is just the latest in a long, long history of financial irregularities involving the Defonsecas. When the regrettable form letter (below) was sent from Congregation Agudah Achim in December of 1999, the mailing list included not only members of the Jewish community, but many others who believed Misha Defonseca’s fraudulent Holocaust story. It is clear that none of Misha’s supporters had any idea that Misha and Maurice Defonseca were hiding their assets and income, nor that the Defonsecas were soliciting money, goods and services based on knowingly fraudulent representations.

Using forensic genealogical methods and financial analysis, we have begun to compile a financial time line. The following sources were used to create this report:

Public records including deeds, foreclosure notices and recorded liens in the Registry of Deeds, Norfolk County, Massachusetts on the Defonsecas’ residence at 7 Bogastow Circle, Millis, MA, from 1985 to June 2001 [www.norfolkdeeds.org.]

Bankruptcy records for February 2001 through May 2001 for a Chapter 13 bankruptcy petition filed by Maurice Defonseca to eliminate unpaid debts, some stemming from the early 1990s, as well as more than $50,000 in unpaid personal loans from individuals [United States Bankruptcy Court, District of Massachusetts, Case number 01-40839 JBR.]

The Massachusetts Department of Revenue records indicate in the bankruptcy petition that the Defonsecas did not file tax returns or pay Massachusetts income taxes for at least a decade from 1990 through 2000 [United States Bankruptcy Court, District of Massachusetts, Case number 01-40839 JBR.] Based on an estimated $44,000 in back state taxes owing for this period, payment for which was a requirement of the bankruptcy plan, Maurice Defonseca’s bankruptcy petition was withdrawn.

Bank records for three of the Defonsecas’ Middlesex Savings Bank accounts for the period December 1996 through March 2001 produced through discovery in the lawsuit [MICV 1998-02-456] against Jane Daniel and Mt Ivy Press.

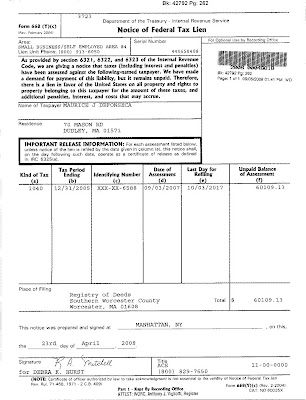

The Worcester County, Massachusetts Registry of Deeds masslandrecords.com/malr/index.htm for the Defonsecas’ residence at 70 Mason Road, Dudley, MA, purchased in November 2003.

The Middlesex Superior Court trial court held in its Findings of Fact (MICV 1998-02-456):

“The Defonsecas' three bank accounts reveal deposits between December 1996 and February 2000 of over $243,700.00. The evidence never made clear how, notwithstanding that amount of deposits, the Defonsecas were claiming financial hardship, such that their home was foreclosed upon in 2001.”

The Norfolk County Registry of Deeds records indicate that the Defonsecas’ Millis home was not foreclosed as they claimed, but actually sold for a profit in June of 2001. The Defonsecas were not suffering financial hardship at the time they sold their home, but were hiding cash and other assets, while soliciting money, goods and services.

This pattern of misrepresentation was also true in December 1999, when the Congregation Agudah Achim solicitation letter went out. The Defonsecas were portraying themselves as being in desperate financial circumstances. In fact, the $50,000 in personal loans shown in the 2001 bankruptcy filing are not included in the $243,700 income confirmed by the court for the period including 1997, 1998 and 1999. Despite around $300,000 of income during this roughly three-year period, the Defonseca’s attorneys, as well as veterinarians, therapists, and other service providers were persuaded to provide their services for free. Of the people who were solicited for cash, the 2001 bankruptcy petition indicates that the amounts actually procured by the Defonsecas included as much as $20,000 from just one person.

What we currently know about the fraudulent solicitations is as follows.

° The Defonsecas made a habit of withdrawing large sums of cash from their bank accounts. Misha Defonseca’s cash withdrawals, from just one Framingham bank account (Middlesex Savings Bank, primarily from account #223631634) in 1999 totaled $53,920.

° The pattern of fraudulent solicitation is exemplified by the fact that the Defonsecas withdrew $10,000 in cash in March 1999 – just two weeks before the March 24, 1999 Boston Globe Dances With Wolves (Archive fee) article by Stephen Bailey reported the following:

In a lawsuit, Defonseca has charged that tiny Mt Ivy Press, L.P. has withheld royalties and underreported sales. Defonseca says she and her husband, Maurice, are in danger of losing their Millis home and have been reduced to taking food from Jewish charities.

“I would like to see Jane Daniel and Brett Kates eating dog food, as we had to, while they were withholding at least $27,000 owed to me for several months, somewhere in a bank account in the West Indies,” Defonseca says.

° This particular instance illustrates the discrepancy between what the Defonsecas were saying publicly, what the facts were, and what they were actually doing. In addition to their misrepresentation that they were destitute, the other alleged facts were also false or misleading. Note that there is no mention in the article that there was a June 1998 motion by the attorney for Misha’s ghostwriter, Vera Lee, asking the court to hold in escrow Mt Ivy Press’ earnings, which included the royalty payments. The motion was granted and thus the royalties were suspended. Nor does the article explain that the French book revenue was direct-wired from Editions Robert Laffont into Misha Defonseca’s bank account. (Laffont never paid royalties to Mt Ivy Press.)

There are still other unanswered questions raised by the facts contained in public records.

° 1994 marked the beginning of unpaid debts showing up in liens against the Defonsecas’ Millis home. By 1997 Misha Defonseca’s cash withdrawals from the Middlesex Savings Bank accounts totaled $54,000 from more than $102,000 in deposits. 1998 cash withdrawals grew to more than $74,000 from another $102,000 in 1998 deposits. At least one payment of $6,600 from Mt Ivy Press for the Disney option did not show up in these deposits. Where did this money go?

Another poignant example of the Defonseca’s exploitation of the generosity of individuals is this: A one thousand dollar short-term loan was solicited by Maurice Defonseca in April of 1997 purportedly to use for a mortgage payment. It was documented by a promissory note signed by Maurice Defonseca agreeing to repayment in May 1997. It remained unpaid in 2001, according to the bankruptcy records – despite the fact that the Defonsecas’ bank statements showed more than $65,000 in deposits from January through April of 1997. Why hadn’t they repaid a man who loaned them $1,000 in April of 1997, when they had access to more than one hundred thousand dollars in both of the years 1997 and 1998? How many other people gave them money and were not repaid?

In fact, when the Defonsecas refinanced their Millis home mortgage in July of 1998, they only took a little over $1000 in cash from these Middlesex Bank accounts for the months of July through September of 1998. What were they living on for that three-month period in 1998? Where did it come from? Where was it being held? How many other sources of income and accounts did they have?

The 2001 bankruptcy file also lists nine other individuals who provided un-repaid personal loans to the Defonsecas for the following amounts:

$20,000.00

$16,000.00

$4,000.00

$2,800.00

$2,000.00

$1,200.00

$1,500.00

$1,000.00

$1,000.00.

Not only do the Defonseca’s Middlesex Savings Bank accounts indicate large deposits and cash withdrawals, the records also show that the Defonsecas made a habit of depositing only a tiny fraction of large checks, while taking the balance of the check in cash at the time of deposit. Thus one deposit is recorded as $12.50, but the check cashed was $2,512.50. $2,500 was taken in cash, while the bank statement indicates a deposit of only shows $12.50. The cash withdrawal total for just this one bank is incomplete.

When the Defonsecas sold their Millis home in June of 2001 for $325,000 - but claimed that they had lost it to foreclosure, they were given shelter, food, medicine, and other gifts at the home of a Milford woman who took them in believing that they were homeless and destitute. In reality, they had at least $90,000 in earned income for the year, and still continued to solicit aid from others.

By November of 2003, the Defonsecas had finally exhausted the emotional and financial resources of the compassionate woman who took them into her Milford home. She was forced to engage a lawyer to evict them from her home. They immediately purchased a new home in Dudley, MA for $190,000 plus two new cars with cash, and left more than $17,000 worth of damage at the home of the woman who had supported them for two and a half years.

During this period Misha approached a decorated Viet Nam vet whom she met years earlier at a speaking engagement in a prison where he incarcerated. She told him she was desperate and had lost her home to foreclosure. His 48 year-old wife was dying of cancer at the time. Misha knew that the vet was receiving a military pension. She told him, Your wife is dying and you are in prison so you don’t need the money. He sent her approximately $500 a month until the federal government suspended pension payments for all incarcerated veterans.

This analysis is preliminary and likely represents only the tip of the iceberg of fraudulent financial activity by the Defonsecas.

1 comment:

As promised - my posting has been placed at my blog:

http://911liarsexposed.blogspot.com/2008/08/trials-and-tribulations-of-jane-daniel.html

I am hoping that the law can undo the injustices you've suffered at the hands of a charlatan.

Post a Comment