Rabbi Earl Kideckel 5/15/08

Temple Beth Torah

Holliston, MA

Dear Rabbi Kideckel,

Since we have not had the opportunity to speak together, I must make some assumptions in writing this letter. First, I assume that you know who I am. I was Misha Defonseca’s publisher, the one that she sued and against whom she won a massive judgment. I also assume that you are aware that Misha has admitted that her memoire was a hoax.

I am not sure whether you are familiar with a letter that was written by Naomi Aigner, president of Congregation Agudah Achim in December 1999 concerning that lawsuit and me. It is about that letter that I am writing you now.

I first saw the letter about a year before the trial. The woman who showed it to me was upset because she had extended enormous effort in support of Misha and she was shocked at being asked to give money as well. I, too, was shocked — by the contents of the letter and by the scathing, defamatory description of me. The letter contained many falsehoods including the statement that Misha was impoverished because of my publishing company and me.

At the time, Misha was not impoverished. I recently had subpoenaed her bank records and seen that she had almost a quarter of a million dollars passing through her accounts in the previous three years. Much of this money was as a direct result of my actions in enabling the publication of the French book. I am attaching the analysis of Misha’s finances in 1999 prepared by the genealogist who uncovered Misha’s fraud, so you can see for yourself.

Recently, other people have given me copies of that letter. I shudder to think how many people were sent the letter, how many others were shown the letter second-hand, how many more heard about it. I cringe at the thought that people believed such horrible things about me. Coming, as it did, under the letterhead of the temple, signed by the president of the temple, that letter undoubtedly has done inestimable damage to my reputation.

That said, I want to be perfectly clear that I do not blame Naomi Aigner, nor the temple, nor the rabbi, nor any of the Jewish people, nor anyone who passed the letter on. I know Misha, and how convincing she can be. I have seen how she turns people against each other and erects walls of fear and anger. I met a woman named Pat who gave Misha $2,000. Misha never told their mutual friend, Sharon, about the gift but instead said to Sharon that Pat had stolen $100 from her at a book signing. By turning people against each other and inciting distrust Misha kept people from talking and comparing notes about what they knew about her. That was one of the ways she maintained the hoax for two decades.

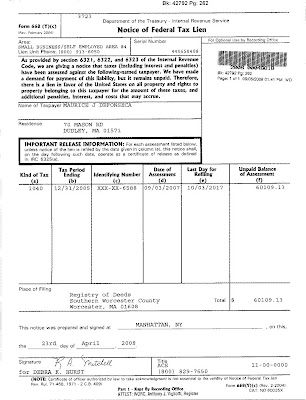

You may also know that I have engaged the services of an attorney and filed a complaint to overturn the judgment. What you may not know is that Misha was responsible for destroying my publishing company and my livelihood, stripping me of all my assets and ruining my reputation. Her attorneys sued my 86-year-old-father and seized my inheritance. They sued my daughter who still has a multimillion dollar lien on her home. I have spent the past ten years being mercilessly hounded by lawyers attempting to collect the $33 million judgment. It has been a living hell. And it’s still going on; just last week I got a threatening letter from Maurice.

I am writing to you today in the cause of truth and healing. I have no desire to extend the harm that Misha did to the Jewish people whom she so ruthlessly exploited. We all opened our hearts to her. We were all her victims. We are all traumatized. As a gesture of good will I want to tell you that, should you wish it, you may have an attorney of your choosing draft a Covenant Not to Sue in regard to that letter and I will sign it, no questions asked.

I would only request that those who were exploited by Misha to stand up and tell the world what happened to them — as a way of bearing witness, if you will. Right now we are all isolated in our own pain. I am hoping we can all join together and say, This is wrong. This is intolerable. This must stop. Now!

Without that effort, it will not stop. I have learned from two European journalists that Misha is working on another book. One of them said to me, “It will be more lies.” Misha and Maurice and their hoax machine are not going away unless people who know the truth decide that it’s time to call a halt to the deceit.

Karen Schulman has begun the process of gathering the truth. She has started a new blog:

http://silenceequalspermission.blogspot.com/

I hope that those who have been harmed by Misha and Maurice will speak out. The blog is one way to do that. Anyone wishing to post a message anonymously on the blog may do so.

Karen Schulman has offered to host a meeting between you, me, and possibly Sharon Sergeant at her home. Of course, you would be welcome to bring anyone else you think should be involved. I believe such a meeting would be one way to begin to pick up the pieces and move on.

Please let me know if you are agreeable to that.

Best wishes,

Jane Daniel

978 281-7732